Do You Encounter These Situations While Saving?

-

Struggling to reach your financial goals or feeling far from them.

-

Living paycheck to paycheck.

-

Rising living costs: Increases in rent or utility bills can diminish your savings potential.

-

Relying on family or friends for financial support.

-

Barely hitting your financial dreams or a long way to go.

-

Living Paycheck to Paycheck.

-

Rising Living Costs: Increases in rent or utility bills can eat away at your savings potential.

-

Relying on family or friends for financial support.

- Barely hitting your financial dreams or a long way to go

- Living Paycheck to Paycheck

- Rising Living Costs: Increases in rent or utility bills can eat away at your savings potential

- Relying on family or friends for financial support

What Opportunities Are You Missing by Focusing Solely on Saving?

-

Keeping your money idle for easy access may prevent you from growing your wealth.

-

Trapping your funds in savings limits your financial growth potential.

-

Failing to diversify can increase risk; there are investment options that offer attractive returns.

-

The misconception that you need significant funds to start investing can hold you back.

How Can First Capital Help?

-

Stay updated on macroeconomic trends through our in-house research team, which covers fixed income and equities.

-

As a full-service investment institution, we offer a variety of investment options tailored to your needs, including government securities, unit trust funds, corporate debt, and stock trading.

-

Access the right tools to manage your investments, such as our online portal and WhatsApp support for unit trust funds.

-

We will keep you informed through our WhatsApp channels, webinars, and social media updates.

Innovative Investment Tool

Your money, your rules! Investments often require a time commitment, but with the First Capital Money Plus Fund, you can enjoy both instant access and daily interest on your funds.

Save Your Monthly Investment Portion

Accelerate your investment goals. Boost your monthly savings with the Money Plus Fund. Enjoy attractive returns without sacrificing liquidity.

Why You Should Invest in Unit Trust Funds? [Interesting Facts about UT]

Sri Lanka's Unit Trust Fund Industry Total AUM is approximately LKR 549 Bn as of end August 2024.

There are 16 active Fund Management firms in Sri Lanka

First Capital Asset Management was the first to introduce a type of unit trust fund that gives you an ATM debit card for instant access

There are 78 different Unit Trust Funds in Sri Lanka

Sri Lanka's Unit Trust Fund Industry Total AUM is approximately LKR 549 Bn as of end August 2024.

Sri Lanka's Unit Trust Fund Industry Total AUM is approximately LKR 549 Bn as of end August 2024.

There are 16 active Fund Management firms in Sri Lanka

There are 16 active Fund Management firms in Sri Lanka

There are 78 different Unit Trust Funds in Sri Lanka

There are 78 different Unit Trust Funds in Sri Lanka

First Capital Asset Management was the first to introduce a type of unit trust fund that gives you an ATM debit card for instant access

First Capital Asset Management was the first to introduce a type of unit trust fund that gives you an ATM debit card for instant access

Innovative Investment Tool

Your money, your rules! Investments often require a time commitment, but with the First Capital Money Plus Fund, you can enjoy both instant access and daily interest on your funds.

Save Your Monthly Investment Portion

Accelerate your investment goals. Boost your monthly savings with the Money Plus Fund. Enjoy attractive returns without sacrificing liquidity.

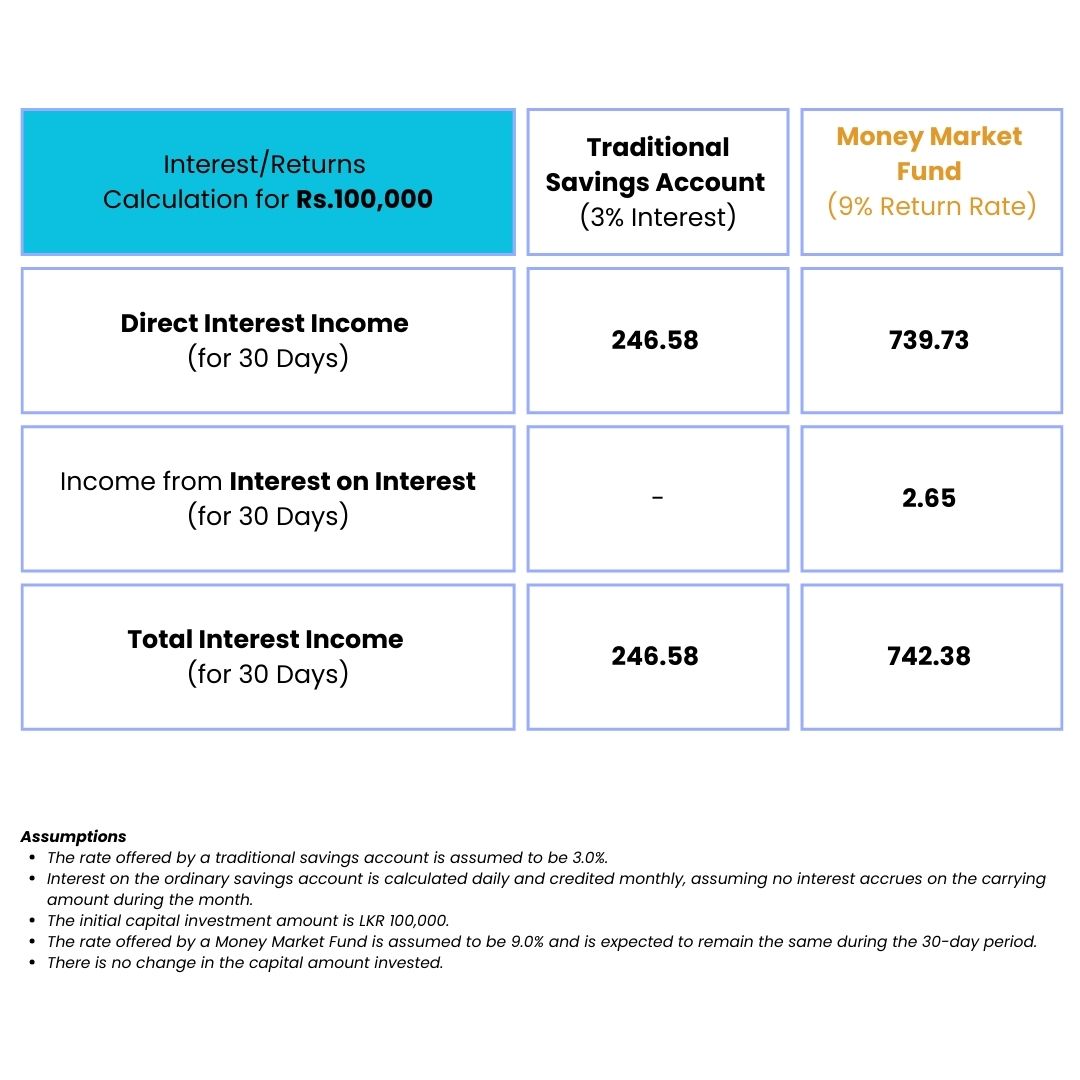

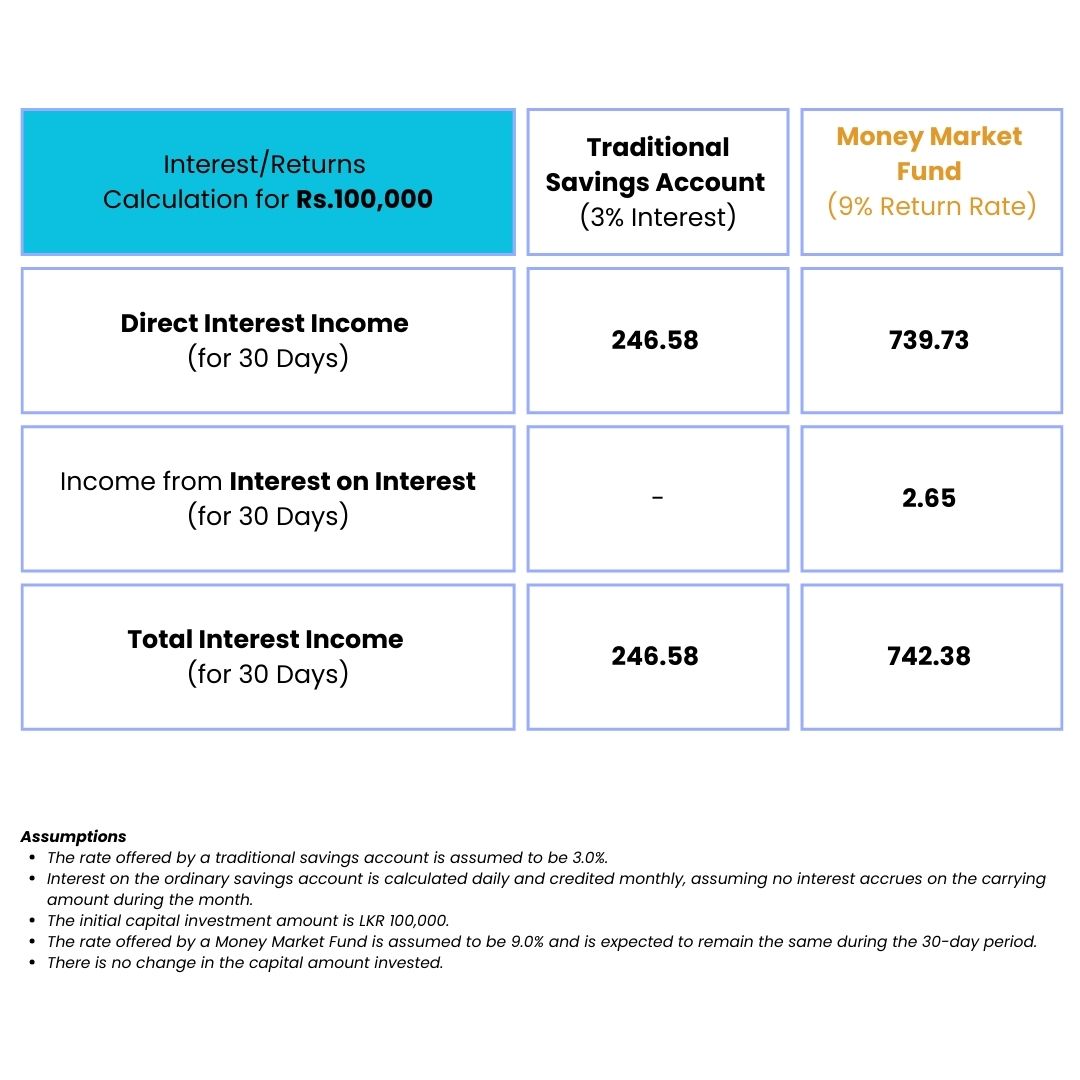

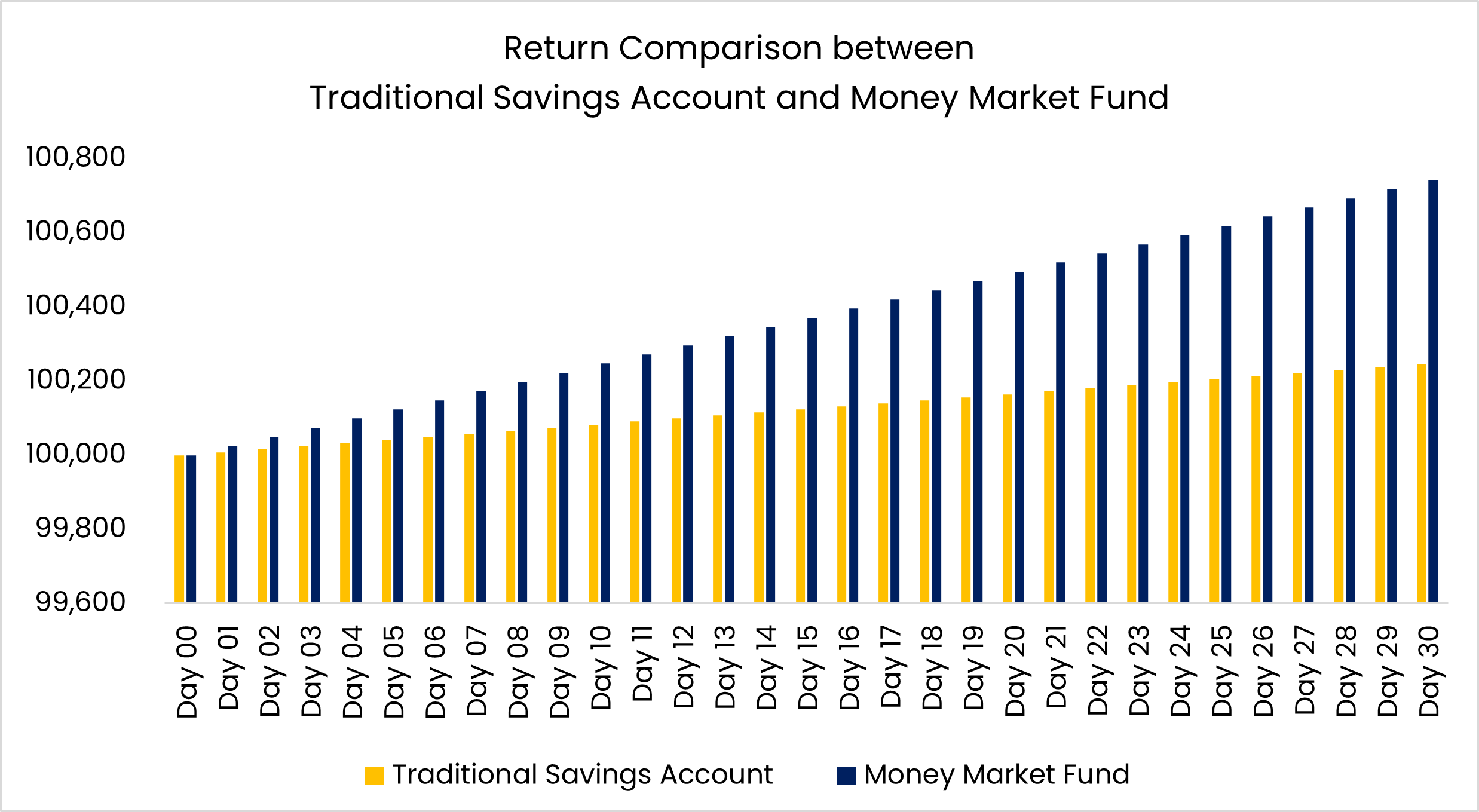

How much would you make in a savings account and a unit trust account:

A comparison between if you invested in last year how much you could make in a savings account and in a Unit Trust Fund account